Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana (SSY). It’s like a piggy bank, but way better!

So, back in 2015, our government launched this awesome initiative called ‘Beti Bachao, Beti Padhao‘ to promote education and empowerment of girls. As part of that, they introduced SSY, which allows parents or guardians to open a special savings account for their little princess.

Here’s the best part – you can open this account at any authorized commercial bank or even at your local post office branch. How convenient is that?

But wait, it gets better! These SSY accounts offer a fantastic interest rate of 8.2%! Can you believe it? That’s way higher than most regular savings accounts out there.

Now, I know what you’re thinking – “How do I figure out how much my savings will grow with this amazing interest rate?” Well, my friend, that’s where the Sukanya Samriddhi Yojana calculator comes in handy.

So, if you’ve got a daughter or a girl child in your family, do yourself a favor and look into the Sukanya Samriddhi Yojana. It’s a fantastic way to secure her future while also enjoying some sweet, sweet returns on your investment. Trust me, your future self will thank you!

Sukanya Samriddhi Yojana Interest Rates (Last 5 Years)

| Year | Quarter | Interest Rate (%) |

|---|---|---|

| 2024 (Jan – Mar) | Current | 8.2 |

| 2023 | Oct – Dec | 8.0 |

| Jul – Sep | 8.0 | |

| Apr – Jun | 8.0 | |

| 2022 | Jan – Mar | 7.6 |

| Oct – Dec | 7.6 | |

| Jul – Sep | 7.6 | |

| Apr – Jun | 7.6 | |

| 2021 | Jan – Mar | 7.6 |

| Oct – Dec | 7.6 | |

| Jul – Sep | 7.6 | |

| Apr – Jun | 7.6 | |

| 2020 | Jan – Mar | 8.4 |

| Oct – Dec | (Data Not Available) | |

| Jul – Sep | (Data Not Available) | |

| Apr – Jun | (Data Not Available) | |

| 2019 | Jan – Mar | 8.5 |

| Oct – Dec | 8.5 | |

| Jul – Sep | 8.1 | |

| Apr – Jun | 8.1 |

How Does the SSY Calculator Work?

So listen up, this SSY scheme is like a marathon, not a sprint. The finish line is 21 years away when your little girl becomes a full-fledged adult. But don’t worry, you don’t have to run the entire distance in one go.

Here’s the deal – you gotta make at least one contribution every year until your girls turns 14. Think of it as fueling up for the long journey ahead. But after that, it’s totally up to you if you want to take a break and catch your breath.

You can choose to skip making contributions from year 15 all the way till year 21 if you want. And guess what? Your previous investments will still be working hard, earning interest at that sweet 8.2% rate. It’s like having a money-making machine running in the background!

Now, when it’s time to cross that finish line at year 21, the final amount you’ll receive is calculated based on your total contributions plus all the interest it has earned over the years. Neat, right?

But how do they crunch those numbers, you ask? Well, the Sukanya Yojana calculator uses a fancy-schmancy formula that looks like this:

A = P (1 + r/n) ^ nt

- A = Future value (total amount)

- P = Principal amount (initial investment)

- r = Interest rate (as a decimal)

- n = Number of times interest is compounded per year

- t = Number of years

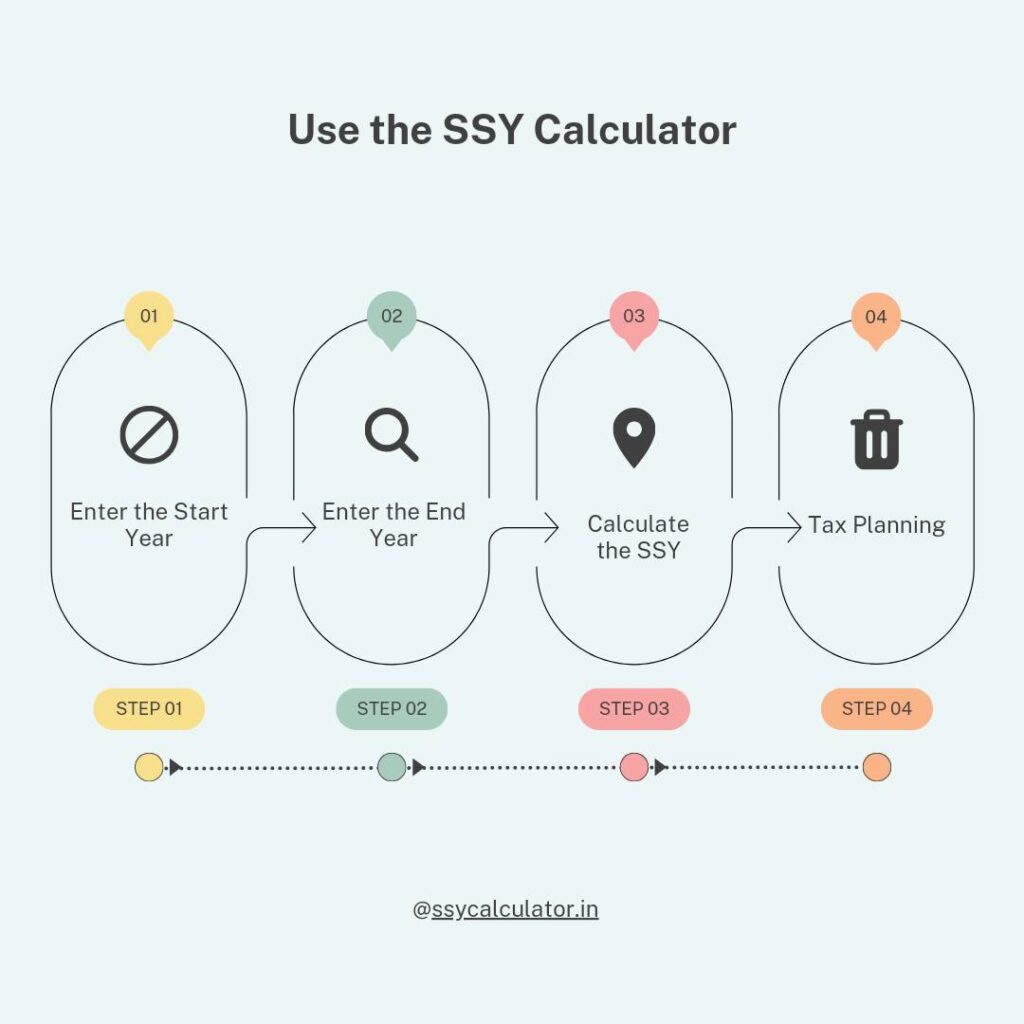

How to Use the SSY Calculator

Step 1: Enter the Start Year

Open the SSY calculator and enter the starting year of the range you wish to analyze.

Step 2: Enter the End Year

Next, enter the ending year of the range.

Step 3: Calculate the SSY

Once you have entered the start and end years, click the “Calculate” button to obtain the sum of the smallest years within the specified range.

20-Year Investment Growth

If the interest rate is 8.2% compounded annually, here’s the updated table for a 20-year investment period with a Rs 100,000 initial corpus and an annual deposit of Rs 100,000:

| Year | Opening Balance | Deposit | Interest | Closing Balance |

|---|---|---|---|---|

| 1 | Rs100,000 | Rs100,000 | Rs8,200 | Rs208,200 |

| 2 | Rs208,200 | Rs100,000 | Rs18,640 | Rs326,840 |

| 3 | Rs326,840 | Rs100,000 | Rs31,828 | Rs458,668 |

| 4 | Rs458,668 | Rs100,000 | Rs47,775 | Rs606,443 |

| 5 | Rs606,443 | Rs100,000 | Rs66,152 | Rs772,595 |

| 6 | Rs772,595 | Rs100,000 | Rs87,456 | Rs960,051 |

| 7 | Rs960,051 | Rs100,000 | Rs112,617 | Rs1,172,668 |

| 8 | Rs1,172,668 | Rs100,000 | Rs142,446 | Rs1,415,114 |

| 9 | Rs1,415,114 | Rs100,000 | Rs177,788 | Rs1,692,902 |

| 10 | Rs1,692,902 | Rs100,000 | Rs219,663 | Rs2,012,565 |

| 11 | Rs2,012,565 | Rs100,000 | Rs269,597 | Rs2,382,162 |

| 12 | Rs2,382,162 | Rs100,000 | Rs329,268 | Rs2,811,430 |

| 13 | Rs2,811,430 | Rs100,000 | Rs400,586 | Rs3,312,016 |

| 14 | Rs3,312,016 | Rs100,000 | Rs485,218 | Rs3,897,234 |

| 15 | Rs3,897,234 | Rs100,000 | Rs585,121 | Rs4,582,355 |

| 16 | Rs4,582,355 | Rs100,000 | Rs702,312 | Rs5,384,667 |

| 17 | Rs5,384,667 | Rs100,000 | Rs839,992 | Rs6,324,659 |

| 18 | Rs6,324,659 | Rs100,000 | Rs1,001,222 | Rs7,425,881 |

| 19 | Rs7,425,881 | Rs100,000 | Rs1,190,311 | Rs8,716,192 |

| 20 | Rs8,716,192 | Rs100,000 | Rs1,411,421 | Rs10,227,613 |

How Can SSY Calculator Help You?

The Sukanya Samriddhi Yojana (SSY) calculator helps estimate future corpus based on investment amount and tenure, enabling guardians to plan for their girl child’s education and future needs efficiently through this government-backed savings scheme offering attractive interest rates.

- Financial Planning: Helps plan investments for a secure future.

- Estimate Returns: Calculates maturity amount based on specified interest rates.

- Goal Setting: Assists in setting financial goals for the girl child.

- Decision Making: Facilitates informed decisions on investment amounts and tenures.

- Tax Planning: Evaluates potential tax benefits under section 80C.

- Monitoring Progress: Tracks the growth of the investment over time.

- Scenario Analysis: Allows exploring different deposit scenarios for optimal results.

- Educational Planning: Useful for planning funds for the girl child’s education.

- Empowerment: Empowers parents to make informed investment decisions for their daughter’s future.

- User-Friendly Tool: Provides a convenient and user-friendly interface for hassle-free calculations.

Exporting and Sharing Results

SSY calculator provide the ability to export the results in various formats, such as CSV or Excel files, for further analysis or sharing with others.

Frequently Asked Questions about Sukanya Samriddhi Yojana (SSY)

Who can open an SSY account?

An SSY account can be opened by a guardian for a girl child below 10 years of age.

How many SSY accounts can I have?

Generally, only one SSY account is allowed per girl child. However, a maximum of two accounts can be opened in a family – one for each girl child, or for twins/triplets.

What is the minimum deposit amount for SSY?

The minimum amount required to open an SSY account is Rs. 250. There’s also a minimum annual deposit requirement, which varies depending on the source you consult (it might be Rs. 1,000).

Can I deposit online in an SSY account?

Yes, deposits can be made online through e-transfers if your bank or post office offers internet banking with core banking functionality.

What is the interest rate on SSY accounts?

The interest rate for SSY accounts is fixed (8.2%) by the government every quarter and applies to both banks and post offices.

Are there any tax benefits for SSY?

Yes, SSY offers several tax benefits. The investment falls under the Exempt-Exempt-Exempt (EEE) category, meaning deposits, interest earned, and maturity amount are all exempt from income tax. You can also claim a deduction of up to Rs. 1.5 lakh under Section 80C for deposits made in the SSY account.

What happens if I miss a deposit?

If you miss the minimum annual deposit, your account will be categorized as irregular. A penalty of Rs. 50 needs to be paid along with the minimum deposit for each missed year to regularize the account.

When can I withdraw money from an SSY account?

The SSY account matures after 21 years from the date of account opening or upon the girl child turning 18 years old and getting married, whichever is earlier. There are some exceptions for premature closure allowed under specific circumstances.

Is there a penalty for premature closure of an SSY account?

Premature closure is generally not allowed. However, exceptions exist for specific reasons like the girl’s medical treatment or higher education expenses. In such cases, partial withdrawal is possible after the girl child attains 18 years of age, but the account will not earn interest after closure.

Where can I open an SSY account?

You can open an SSY account at any authorized bank or post office branch in India.

Conclusion

The SSY calculator is a powerful and efficient tool for calculating the sum of the smallest years within a specified range. Its accuracy, time-saving capabilities, and versatility make it a valuable asset for various applications, from mathematical analysis to financial calculations.

By understanding its features and how to use it effectively, you can streamline your workflows and obtain reliable results with ease.